Management services organizations (“MSO”) have been around for decades serving a multitude of purposes in health care. MSOs colloquially have been referred to as the duct tape for health care business arrangements by health care attorneys. They can fix many problems with a health care deal. When implemented correctly a MSO can be a successful vehicle for several different models, arrangements and reasons. However, if implemented incorrectly a MSO can lead to regulatory scrutiny and risk given the highly regulated health care industry.

This field guide is a five part series and will, after an introduction to the MSO, address in each part the differing uses that MSOs play in health care arrangements:

- Part 1 – What is a management service organization (MSO)?

- Part 2 – Corporate Practice of Medicine (CPOM) Uses

- Part 3 – Regulatory Uses

- Part 4 – Business Structuring Uses

- Part 5 – Exit Plan Uses

What is an MSO?

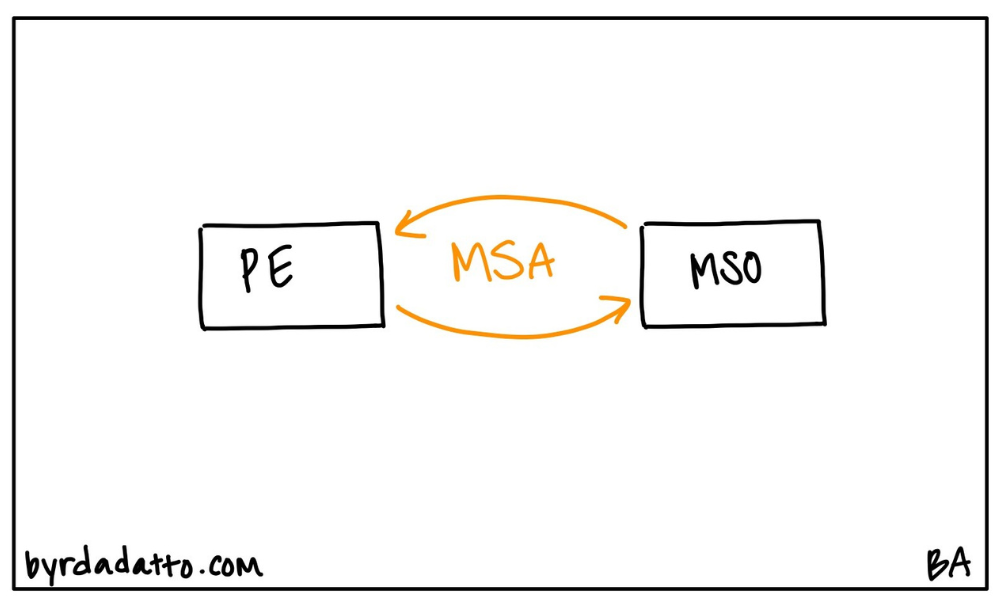

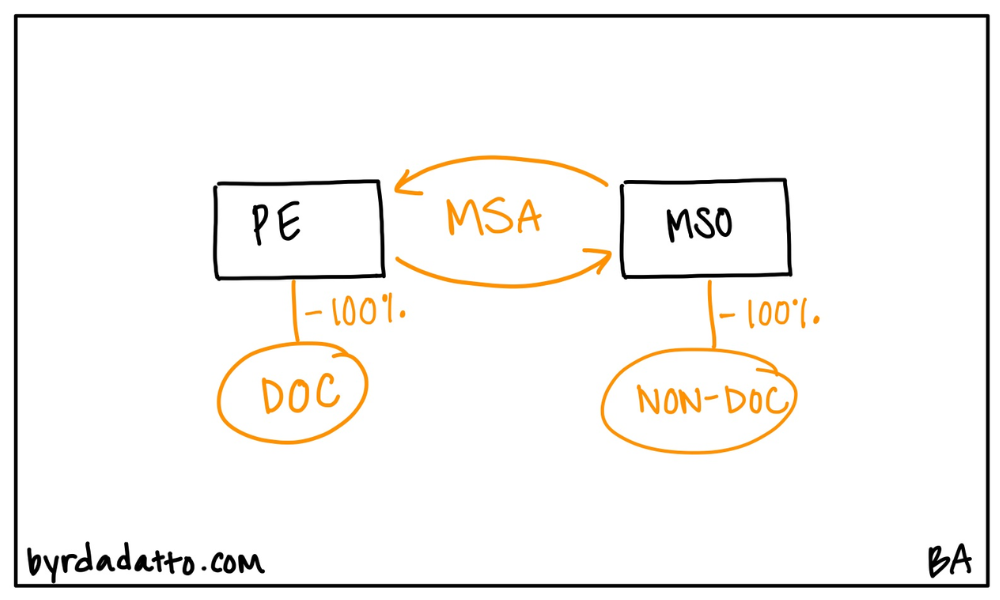

A management services organization (MSO) is an entity whose purpose is to provide management, administrative, and support services to other businesses. In the health care context, the MSO is performing these services for health care entities. Legally, the ingredients of an MSO model are two entities and a contract. Diving deeper, the MSO entity and the professional entity (PE) are the two legally distinct entities and the model is brought to life by a contract called a management services agreement (MSA).

Who Owns an MSO?

An MSO is a non-professional entity. Therefore it can be structured using any type of non-professional entity such as a corporation, limited liability company, or limited partnership. As a result, from a health care regulatory perspective anyone can have ownership, including entrepreneurs, physicians, dentists, non-practitioners, other businesses, individual investors, and private equity firms. To be clear, MSOs are also used in other professional industries where individuals have a state license and cannot allow unlicensed persons to own the entity, such as architecture firms, certified public accounting firms, and law firms.

From a business perspective, it remains important when forming an MSO entity to be strategic regarding the type of entity and the Federal tax election. These decisions do impact boundaries on ownership. This choice of entity strategy and tax election strategy should be developed with business attorneys in concert with tax advisors when starting the MSO.

How Does an MSO work?

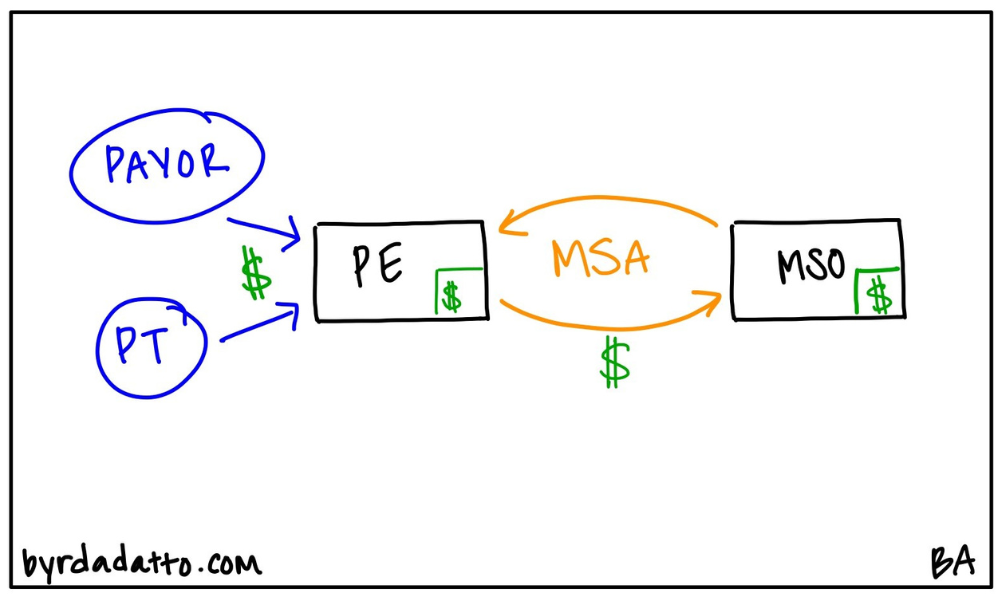

To understand how an MSO works, we must look at the bigger picture of the MSO model. First, imagine a typical health care entity such as a medical practice. When examining its operations, you can break it down into two fundamental components of operations: (1) the clinical operations; and (2) the administrative operations. The MSO model separates these components into a professional entity, the one responsible for the clinical operations and provides the patient care, and a management entity, the one responsible for the administrative operations and handles the business of the practice. These two entities are then tethered legally by the MSA through which the professional entity engages the MSO to provide defined management, administrative and support services for a fee. Done correctly, the MSO in essence, is the outsourced back office business operations of the medical practice.

The MSA is key in two ways: (1) it creates boundaries for the roles of the parties in the arrangement; and (2) it tailors the flow of money to both be compliant and in line with the business goals of the parties.

The boundaries become critical from a compliance perspective. Another important compliance layer to these boundaries is the importance of the parties actually doing what the contract says the party will be doing. This is often referred to informally as “form and substance.” The substance (what actually happens) must align with the form (what the contract says will happen). When these don’t align, compliance issues will arise.

The flow of money can make or break an MSO model from a compliance perspective as well. Behind the uses to be discussed in this field guide are state and federal laws. While the laws differ depending on the circumstances, all the uses rely on proper flow of funds to maintain the integrity of the model. Additionally, the proper flow of money helps align the business plan of the parties with the regulatory issues.

What Services Does an MSO Provide?

As noted earlier, the MSO’s broad function is to serve as the back office business for the health care entity. An MSO consequently offers virtually any aspect of non-clinical support, including billing and collections, accounting, negotiating and contracting with vendors, leasing space and equipment, handling IT services, staffing, acquiring insurance, regulatory compliance, and licensing intellectual property to the practice (trademark, website, social media) and sometimes marketing.

State laws will control the financial and operational boundaries that must be set between the MSO and professional entity. Some states view control of the business as an indirect control over the professional practice of the health care entity and will create limitations on what an MSO can do without professional oversight and approval. These issues are nuanced and addressed on a state by state basis.

What Services Can an MSO Not Provide?

The key principle to understand in determining the services to be provided by an MSO is that it is a non-professional business entity, not a professional one, and should have no role in the chain of patient care. Part Two of this series will dive deeper into the corporate practice of medicine laws and use of the MSO to navigate those laws. It will also dive deeper into the services that should not be provided when using an MSO for corporate practice of medicine purposes.

How Does an MSO Get Paid?

A MSO gets paid compensation for the services provided under the MSA. Permissible payments to a MSO include reimbursement for MSO expenses, like staff, equipment, space, intellectual property, and loan payments, and payment of a management fee. Under a typical management fee model, there generally two options: (1) fixed fee; or (2) percentage of net or gross collections. The type of fee used is influenced by federal and state laws and the business plan of the parties to the arrangement.

Fixed fee is generally the most commonly recommended as it sets forth in advance the management fee and does not increase or decrease based on volume or value of patients receiving professional services. This allows both parties to have risk associated with the fee.

The percentage formula, when used for the management fee, is either based on net or gross collections. The draw to the formula-based approach is the simplicity in setting and tracking the management fee to live with the success or lack of success of the business. On the other hand, the percentage formula often faces regulatory risk (or prohibition) and may not align with the business goals of the parties.

What Are the Ways That Most MSO Models Get in Trouble?

When setting up or using an MSO, it must be carefully structured to adhere to the various health care regulatory requirements. Failing to do so can result in great risk to the model. So where can models fall short?

The MSO may not be a substitute for the licensed professional. Situations in which the physician or another licensed professional contracts with the MSO solely as an owner of the professional entity and has no operational connection to the professional practice can cause issues for all providers in the model.

The MSO model can also run afoul with the rules when the MSO asserts too much control over the clinical operations or the physicians themselves.

The MSO may not be a workaround to pay physicians for patient referrals into the underlying health care business being managed by the MSO. The MSO serves as a common model in physician-owned health care businesses and important restrictions are encountered when the MSO is being used for this purpose. Part Three of the MSO Field Guide will explore these limitations.

In Part Two of this series we will begin discussing the uses for MSOs, beginning with the Corporate Practice of Medicine.

At ByrdAdatto we are working hard to ensure our clients are well equipped and ready for operating their business. If you have questions regarding this alert, email us at info@byrdadatto.com or call 214-291-3200.