Management services organizations (“MSO”) have been around for decades long serving a multitude of purposes in health care. MSOs colloquially have been referred to as the duct tape for health care business arrangements by health care attorneys. They can fix many problems with a health care deal. When implemented correctly a MSO can be a successful vehicle for several different models, arrangements and reasons. However, if implemented incorrectly a MSO can lead to regulatory scrutiny and risk given the highly regulated health care industry.

This field guide is a five part series and will, after an introduction to the MSO, address in each part the differing uses that MSOs play in health care arrangements:

- Part 1 – What is a MSO?

- Part 2 – Corporate Practice of Medicine Uses

- Part 3 – Regulatory Uses

- Part 4 – Business Structuring Uses

- Part 5 – Exit Plan Uses

Exit Plan Uses

Before addressing the use of an MSO for an Exit Plan, it’s important to first understand what the term “Exit Plan” means. An Exit Plan is the last stage in the life cycle of a health care practice. When a practice gets to this stage of planning for the sale of their business, the sale can take many forms. ByrdAdatto internally has terms to help visualize the different concepts of how to construct an Exit Plan. The five most common Exit Plans are: (1) the Fixer Upper Plan, (2) the Sensei Plan, (3) the Mic Drop Plan, (4) the Gordon Gekko Plan, and (5) the Family Heirloom Plan.

Each of these has their own strategy to help guide towards the ultimate goal, which is the sale of the medical practice. There are some times when the MSO will be a tool utilized with the particular Exit Plan. What follows is a look at each of the plans and how the MSO becomes an important piece of the puzzle.

How is the MSO used for the Fixer Upper Plan?

The idea of the Fixer Upper Plan when a practice is getting ready to sell is somewhat intuitive based on the name. Typically, a practice will have some issues that need to be resolved prior to the sale. These can be superficial, like needing a new coat of paint, or deeper problems such as cracks in the foundation. The question then is how to clean the business up in preparation for the sale. There are operational ways to clean things up, such as cleaning up the financials, the corporate structure, or making necessary regulatory updates (Part 3 – Regulatory Uses). There may be times where cleaning up the corporate structure involves the creation of an MSO.

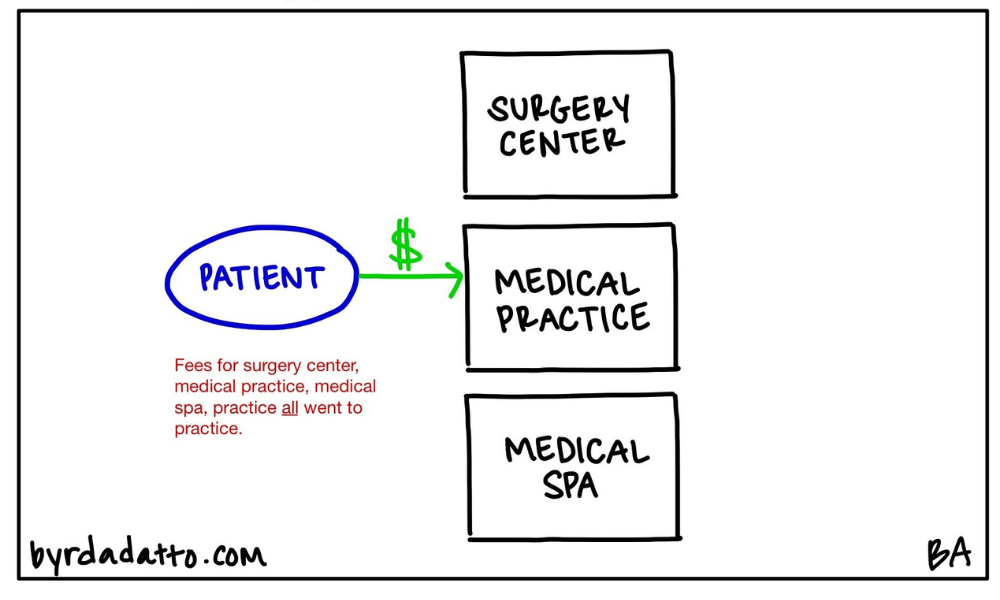

As an example, a client had three different business entities as a part of their medical practice. The client, a plastic surgeon, had a medical spa entity, a surgical practice entity, and a surgery center entity. The financials revealed that all the revenues were flowing through the surgical practice entity and the other two entities were not functioning properly. The practice operationally preferred to have all sources of revenue sitting in one place. However, compliance issues arose by not having the patient pay the surgery center and medical spa for services provided by those entities.

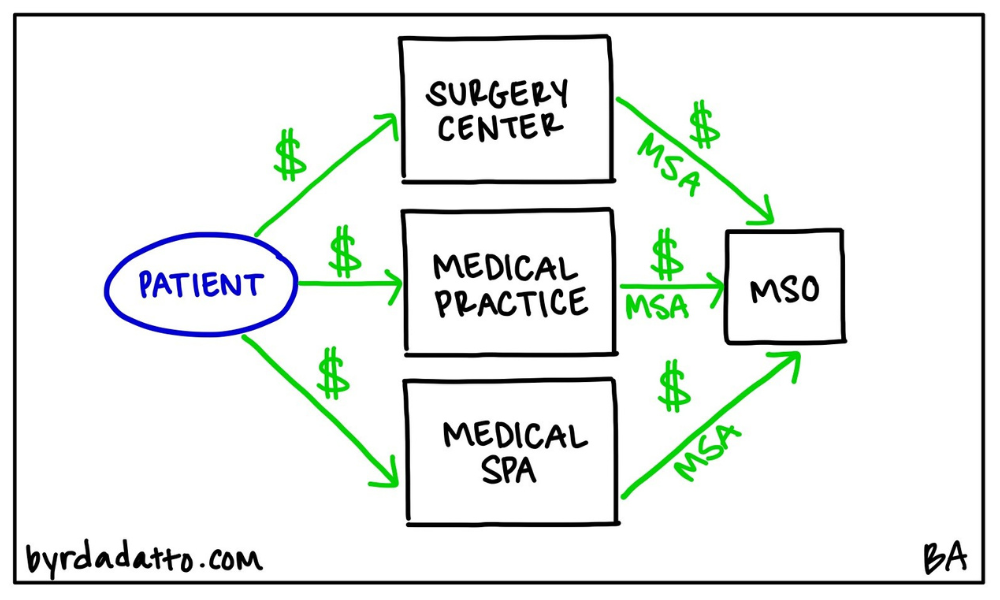

As part of the Fixer Upper Plan to get this practice ready for sale, the revenue streams were organized to involve the appropriate entities so that there were now clearly three functional entities. The MSO entered as a solution to have one place for all the funds to ultimately and compliantly (Part 2 – CPOM Uses) land and allow for the business to operate as it had previously. In this case, one can think of the MSO like a holding company or flagship company. The MSO would manage, through a management services agreement (MSA), each of the three entities with the revenue streams unified under this MSO, similar to the Glue Plan discussed in Part Four.

Based on the context of what was happening with the practice, this was the ideal outcome to be able to create a unified model both from a short and mid-term operational perspective while preparing the practice for sale.

How is the MSO used for the Sensei Plan?

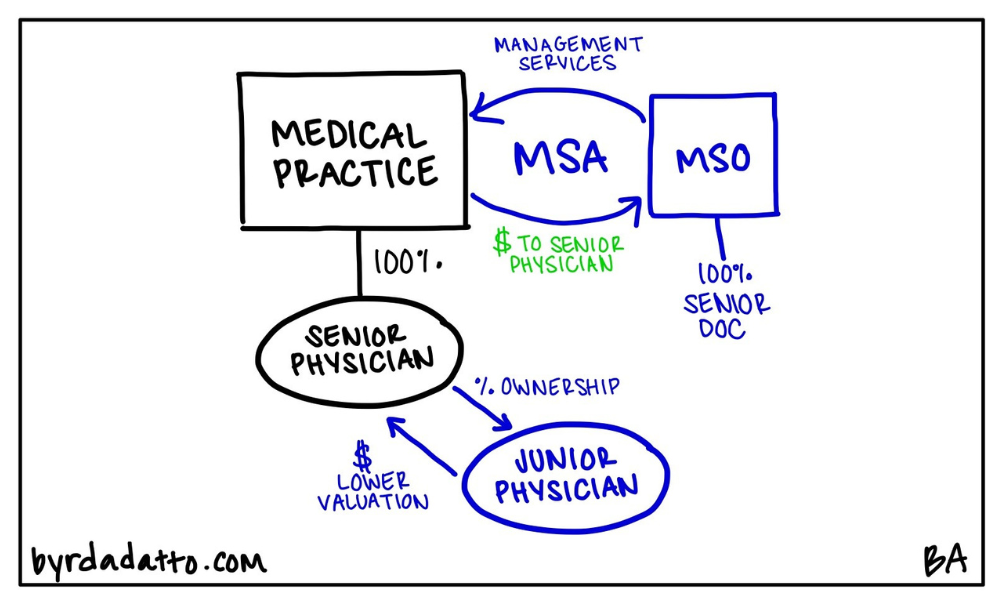

The Sensei Plan is a time tested strategy in the practice of medicine for transition of ownership. The idea is that a physician, once they reach a certain life cycle in the practice, will recruit and hire as an employee another physician to join the practice. As they work together, the senior physician will train the junior physician in all the ways (business and medical) of the practice with the goal of the junior physician becoming a partner in the practice and ultimately buying the senior physician out.

One of the challenges with the Sensei Plan historically has been aligning the value of the practice with the finances of the junior physician. Two issues are raised. First, the senior physician commonly has an inflated view of the value of their practice. The second, which is a competing force to the first, is that oftentimes the junior physician perceives that a medical practice has little to no value. Bridging this gap to find valuation alignment is challenging.

The MSO can sometimes be used as the bridge. Specifically, the MSO can be used to create an economic benefit to the senior physician for the role of running the practice. The allocation of practice revenues, when done appropriately with the help of tax advisors, can be a pre-tax payment out of the junior physician’s revenues. This then allows the physicians to settle on an appropriate lower valuation for the actual purchase of the practice since there is economic upside to the senior physician for ongoing administrative leadership through the MSO.

How is the MSO used for the Mic Drop Plan?

The Mic Drop Plan is for the physician who does not want to sell the practice. Rather, they want to turn out the lights when they are done. Though it may seem counterintuitive, proper planning is still required before dropping the mic.

Most practices have known liabilities, like payroll or real estate and equipment leases that must be considered. Many times these liabilities also have a personal guarantee signed by the physician owner preventing them from turning out the lights and walking away without consequences. Medical practices also have unknown potential liabilities associated with patient care and business dealings. Therefore, a medical practice, by the time of retirement, tends to be a hot zone from a risk perspective.

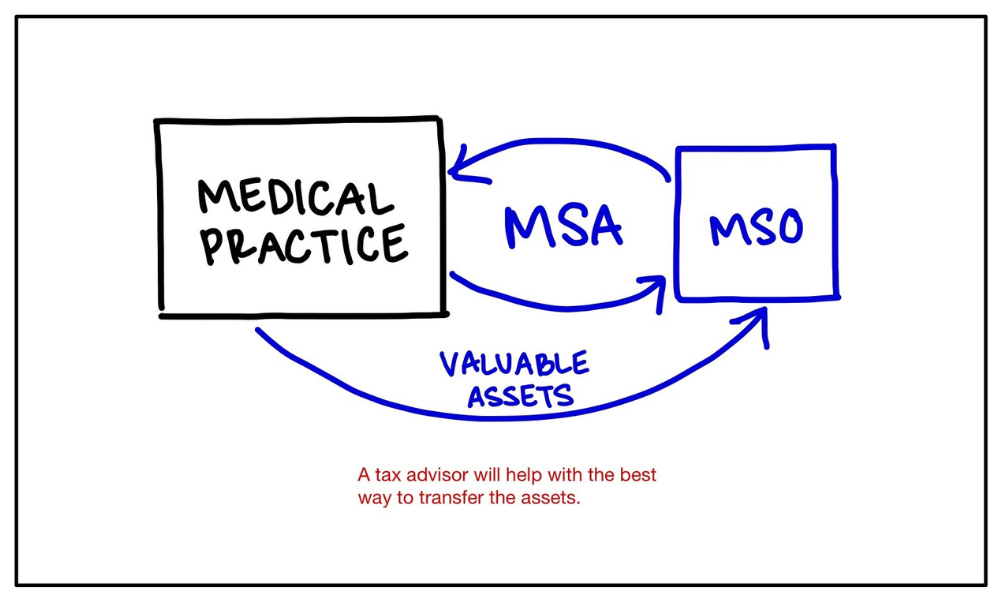

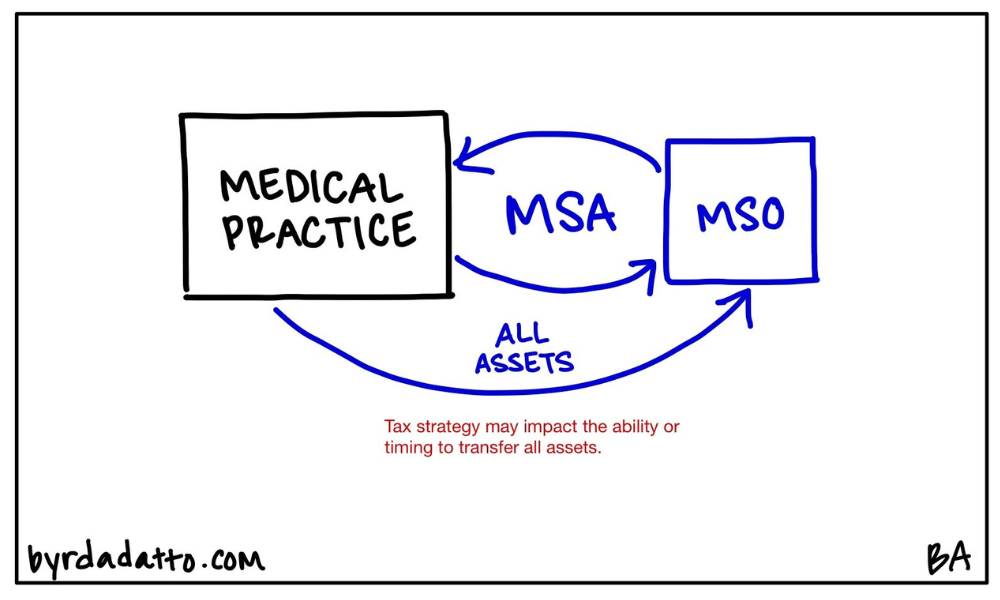

The MSO can be utilized as part of a Mic Drop Plan where there are some useful assets in the practice that the physician does not plan to sell. The desire is to protect those remaining assets and keep them separated from the liabilities that will exist in that practice when the lights are turned out. In advance of the closing of the practice but while it is still operational, an MSO is created and those assets needing to be protected are contributed to the MSO. Since the practice is still operating and needs access to and use of those assets, the MSO provides them back to the practice while it remains operational. When the lights do go out on the practice, the physician has the MSO with a cleaner history from a liability perspective holding ownership over those assets. It should be noted as a word of caution that this strategy can backfire if it’s being done to avoid an existing creditor that is going after the practice or there is potential or active litigation pending as mentioned in connection with the Asset Protection Plan discussed in Part Four.

How is the MSO used for the Gordon Gekko Plan?

The Gordon Gekko Plan, playing off the classic 1980’s movie Wall Street, is the selling of a medical practice to Wall Street a.k.a. private equity. These are sophisticated transactions involving non-physicians. Therefore, the MSO will typically show up in the Gordon Gekko Plan.

The reasons for building an MSO as part of the Gordon Gekko Plan is to, potentially, clean up the practice following the Fixer Upper Plan or to deal with a corporate practice of medicine (CPOM) issue and restructure the practice with a structure that must be utilized for a private equity buyer. This restructure can help with negotiations and due diligence creating a clearer picture with respect to the locations of assets and liabilities. It also helps give an apples to apples comparison for a buyer when they will be buying something that looks the same structurally as what it will be post transaction. Importantly, a lot of issues raised when incorporating an MSO can be ironed out and dealt with when doing it in advance. If done in conjunction with a sale, Wall Street will use that to their benefit in negotiations.

The MSO may also be used if the practice is wanting to scale the business with non-medical investors before it seeks an exit with private equity. A lot of times the practice will use bridge funding or some other form of private money where the principles of CPOM will kick in and the MSO becomes necessary.

How is the MSO used for the Family Heirloom Plan?

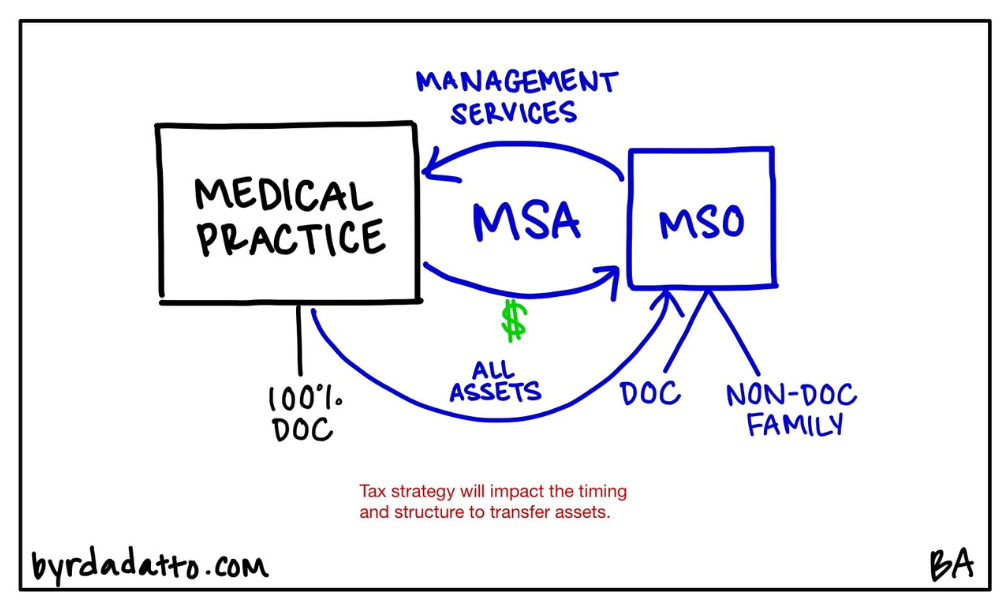

The Family Heirloom Plan is an exit strategy where the physician wants to exit the practice and transition it to a family member. This oftentimes shows up in the form of estate planning and in answer to questions such as: What if the physician dies, what will happen to the practice? What if the physician has a child who has been helping run the practice and the physician wants to continue, from a legacy perspective, to run the practice? Scenarios include the wife who’s been the office manager for years, or the physician’s child who has been helping run the business. The transition is built around the legacy concept and continuation within the family. When a family member is not a physician, the MSO comes into play again.

The purpose of the MSO is to create ownership for the family in the MSO and begin transitioning business operations of the practice to the MSO and flow of money into the MSO. At the same time a plan should be implemented to identify a replacement physician designated to take over as owner of the medical practice entity. Stated differently, the family owned MSO only succeeds with a physician that can step in to replace the role of the physician with respect to the clinical side.

Combinations of Exit Plans

There’s obvious overlap amongst the different uses for an MSO. For example, one particular use may get triggered because of CPOM or regulatory requirements.

Thinking about the use of an MSO in the Family Heirloom Plan in particular, it ends up serving multiple purposes. It alters the business structure to have the business operations effectively come out of the new MSO. It also becomes an asset protection strategy. The biggest liability of a medical practice is the potential for malpractice with patients. The second biggest potential liability of a medical practice is employee related liabilities. When going through the Family Heirloom Plan and shifting assets and the operations into an MSO, the assets become separated from these practice related liabilities.

Finally, there is an estate planning element. It may be an effective strategy to avoid the probate process in the event of the death of the physician as you are able to transition ownership through the creation of the MSO to the family while the physician is living. The Family Heirloom Plan should consequently include an estate planning attorney and appropriate tax advisors.

Contact ByrdAdatto

Over the past five parts of this field guide, we have hopefully inspired you to consider why and how the utilization of a MSO can be a successful vehicle, which will be dependent on your facts and circumstances. You are allowed to use your imagination, albeit limited by regulations, to think of different uses that MSOs play in health care arrangements. If you have any questions or would like to learn more about MSOs, email us at info@byrdadatto.com.