Management services organizations (“MSO”) have been around for decades, long serving a multitude of purposes in health care. MSOs colloquially have been referred to as the duct tape for health care business arrangements by health care attorneys. They can fix many problems with a health care deal. When implemented correctly a MSO can be a successful vehicle for several different models, arrangements and reasons. However, if implemented incorrectly a MSO can lead to regulatory scrutiny and risk given the highly regulated health care industry.

This field guide is a five part series and will, after an introduction to the MSO, address in each part the differing uses that MSOs play in health care arrangements:

- Part 1 – What is a management services organization (MSO)?

- Part 2 – Corporate Practice of Medicine (CPOM) Uses

- Part 3 – Regulatory Uses

- Part 4 – Business Structuring Uses

- Part 5 – Exit Plan Uses

Business Structuring Uses

The previous parts of this series explained the MSO and the impact the model has from a compliance and regulatory perspective. In addition to using the MSO for compliance within the regulatory environment, many businesses use the MSO for business structure purposes. Before exploring why each plan is used, specifically within the health care industry, it is important to first discuss some fundamental structural issues that will be important regardless of the plan being used.

Preliminary Structural Thoughts Before the Plan

When contemplating any plan, there are important structural details that must be examined before moving forward, as what is in place from the start will impact the ability to utilize different business structures moving forward. Oftentimes people don’t give second thoughts to basic business formation decisions like the state of formation or even the type of entity.

Take for example the consideration of forming a Delaware entity which will be solely used in California to help manage a California practice. In this scenario, there are two states whose laws now come into play. Not only must the entity abide by Delaware rules and pay taxes there, but it must also file documents with California’s Secretary of State and pay taxes there as well. If alternatively a California entity is formed, only one state’s laws apply creating more simplicity and less potential administrative hassles. On the other hand, if the MSO has a strategy to scale across multiple states, the idea of picking a traditional business friendly home state like Delaware starts to make more strategic sense.

As to the choice of entity, this decision dictates the federal tax elections available. Generally, an MSO is formed as either a corporation or limited liability company (LLC) given the non-professional purposes discussed in Part One of this series. Every once in a while an MSO will be formed as a limited partnership, but this is rare given limited partnerships’ purposes tend to be on the investment side, not on the operations side.

An LLC can be taxed in four different ways. Once formed by filing the necessary documents with the secretary of state, the LLC applies for an employer identification number with the Internal Revenue Service (IRS).

If it is a single owner (either an individual or entity), the default tax status is as a disregarded entity. A disregarded entity notifies the IRS that the entity will neither file nor pay federal taxes. Instead the individual owner will pay it. Essentially, the owner is telling the IRS to “disregard” the LLC and the taxes will be reported and paid on the personal tax return of the owner.

If there are two or more owners (individuals or entities), the default tax status is as a partnership (except when there are two owners who are married in community property states—they can elect to be treated as a disregarded entity). This election means that the LLC is not going to pay federal taxes and all the taxes will be pushed down to the partners based on their pro rata share of ownership.

Regardless of the number of owners, an LLC can request that the IRS treat it as a corporation from a tax perspective. Two options exist when selecting to be taxed as a corporation: C-Corp or S-Corp. Corporations, such as IBM and Apple, are taxed as C-Corps. This is the default tax status when forming a corporation. A C-Corp will pay federal taxes based on its profits, and then if there are distributions of the profits to the owners, the owners pay taxes. This is often referred to as the double tax because both the entity and the individual will pay federal taxes on the funds being distributed. For an MSO looking to scale and reinvest all profits back into the business for growth, strategic advantages may exist to be taxed as a C Corp.

If a LLC or corporation elects to be taxed as a S-Corp, it will not pay any federal taxes; instead the federal taxes will be allocated based on the pro rata share of ownership, and paid at the individual level. The most important effect of a S-Corp election is that it limits the number of owners to 100 and the owners must be individuals (subject to limited exceptions). Therefore, if considering a MSO with a plan to have investors, and those investors are or may be entities, an S-Corp does not work.

The decisions made in the beginning have to set up a structure that works with the goal and implementation of the particular plan to be used. This is why it is important to understand the implications of different structural formations and crucial to involve tax advisors on these decisions.

Business Structuring Uses for MSOs

Having touched on preliminary structure issues to consider before building out a plan, the next step is to dive deeper into the most common plans where MSOs are used for business structuring purposes.

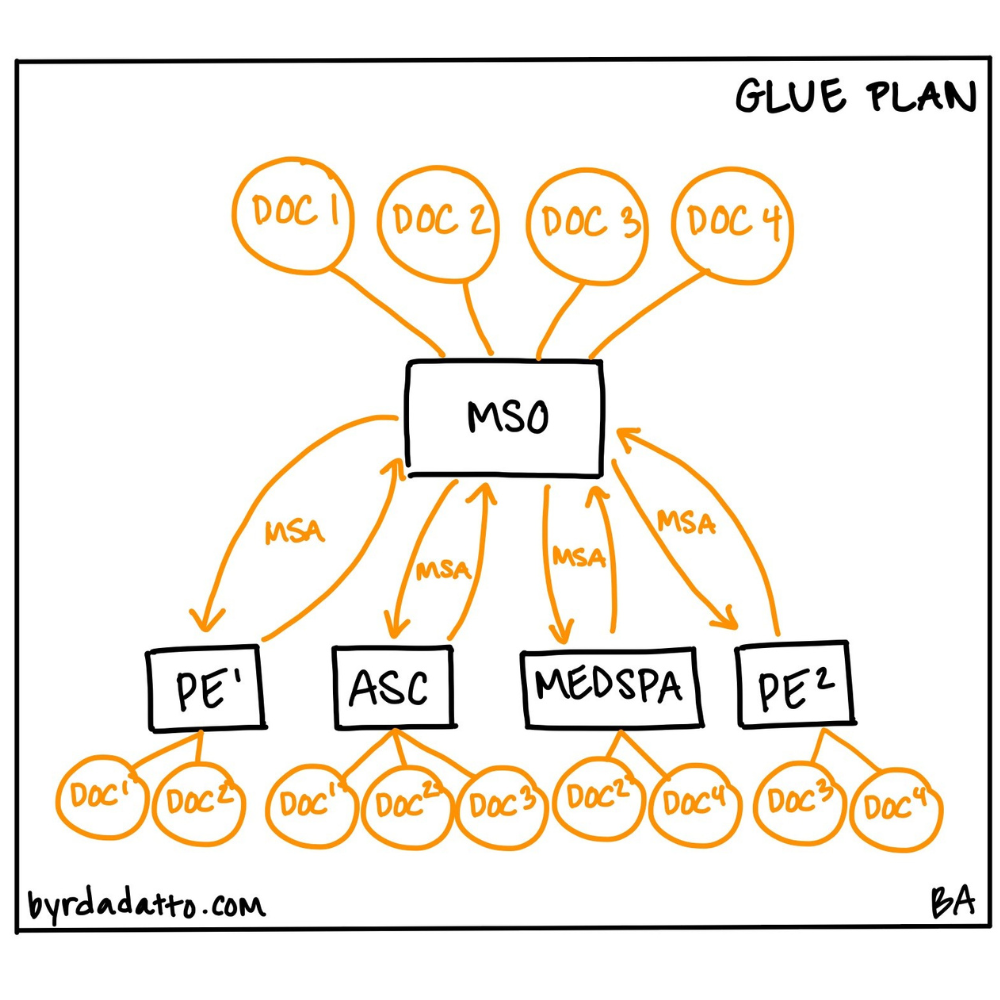

The Glue Plan

The concept behind the Glue Plan is that there are multiple partners who own different independent entities but work collectively together in some way. Think separate doctors who own their own professional entities but share space together, own a MedSpa together, or own a physical therapy company together.

The Glue Plan is best used where the partners have a common business purpose between them, yet are legally independent. The MSO functions as a uniting business entity. These interwoven relationships are pulled together by the MSO allowing the partners to pool resources for the benefit of the group and share the costs, like administrative personnel. For example, as the MSO grows, it now has the power of the purse to hire upper tier talent for the CFO, CEO, or COO, positions that as a singular practice the partners themselves could not otherwise individually afford.

Additionally, the MSO under the Glue Plan can act as a carrot for younger physicians within the group. Besides buying into the medical practice where they are directly contracted, young physicians can be given the opportunity to buy into the other ancillary Glue Plan entities, like the MedSpa, ambulatory surgery center, and the MSO.

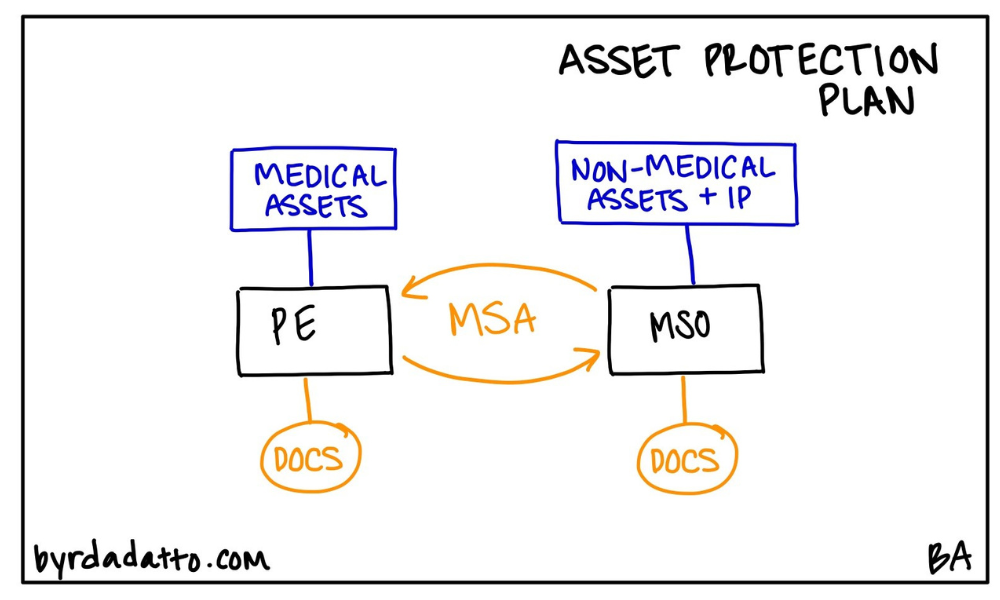

Asset Protection Plan

Depending on one’s risk tolerance, many business owners seek ways to protect their assets. On the personal side, they may have a strong estate plan with trusts and family limited partnerships to protect personal assets. On the business side, these same individuals want to look for ways to protect their business assets.

As most physicians and medical providers understand, they and their medical entities can have huge targets on their backs. They also understand their medical practice can have valuable assets. Therefore, owners must consider how to protect these assets. When thinking through this, one must first consider what other protections are already in place. To start, what type of judgment creditor protections does the state already offer? Next, what type of liability insurance is in place from a personal, professional and entity perspective? Finally, is there a history of aggressive plaintiffs’ attorneys in the state, and do the rules make it easier or harder to be sued for malpractice claims?

Given these considerations, many owners turn to the Asset Protection Plan to legally move medical practice assets to another entity.

In the Asset Protection Plan, owners of the medical practice form a MSO which is often owned by the same people. Once formed, it is determined which assets should be moved to the MSO. The idea with the Asset Protection Plan is for the assets to be moved to and reside in the MSO but leased back to the medical practice where they are used. Since the risk epicenter of the business is the medical practice, the assets become shielded in the MSO from the liabilities of the medical practice.

For protections against claims from outside creditors that the MSO is a sham, the transfer of assets and payments should be done at an “arm’s length” transaction. One critical issue is the timing of the Asset Protection Plan. It must be developed well in advance of any potential litigation or judgment as fraudulent transfer laws exist in most states. If a MSO is formed and cash and assets are moved during active litigation or after a judgment is levied against the medical practice, creditors may not be prevented from going after those transferred cash and assets. Courts in these types of situations may disregard the transfers allowing third party claimants to make claims against the cash and assets no longer in the practice.

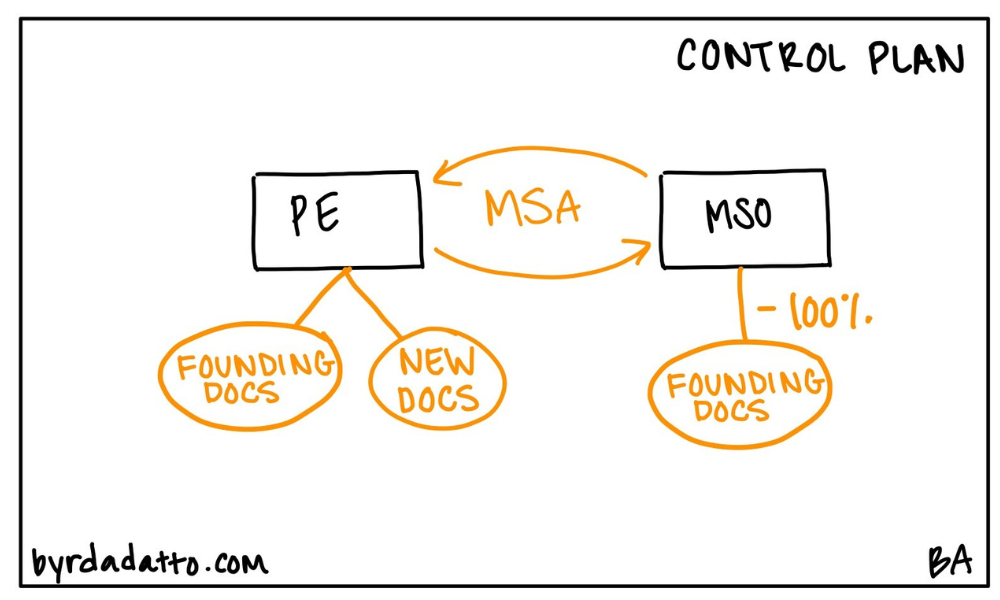

The Control Plan

Often the Control Plan comes into play when a physician or provider has a practice and they want younger partners to have the ability to buy into the practice. However, they also want to ensure management and administration of the practice is controlled by those with knowledge and experience necessary to help make business decisions on behalf of the practice. For the Control Plan set up, founders form a MSO and enter into a management services agreement (MSA) with the practice. The younger partners are then allowed to buy into the practice but not the MSO, leaving the desired control with the founders.

One key issue before admitting the younger partners to the practice is that the MSA, with a well-documented management fee, should be in place first. This creates transparency for the younger partners before obtaining ownership so that they are fully aware of and understand the structure and fees paid to an entity owned by the founders but not by them. The Control Plan benefits the founders by not only providing additional compensation but when done correctly, the founders are still able to control and manage the non-clinical decision making of the practice. It can also act as another carrot for the younger partners when offering the ability to eventually buy into the MSO.

The Master MSO Plan

The Master MSO Plan is utilized when planning to have multiple locations, operate in multiple states, or there will be multiple different owners for each location. It solves a need for one entity to oversee each location utilizing some of the same resources and intellectual property. That one entity is the Master MSO.

The Master MSO typically will own the intellectual property and house the key officers and administrators. The Master MSO helps act as the back office and manage deals for all of the locations or states.

Many times a Master MSO may have initial large investors with several sub-MSOs based on locations. In this situation, the Master MSO is typically the flagship entity where the founders of the enterprise are situated. Given that the Master MSO owns all the intellectual property, i.e. trade names, website, emails, phone numbers, all the protocols and other types of information developed on behalf of the enterprise, it allows the sub-MSOs via a sub-MSA to utilize these assets. The sub-MSO then enters into the main MSA with the professional entity.

The biggest mistake made here is failing to distinguish between the services provided by the Master MSO and sub-MSOs. Risk rises if the services are a straight pass through with all services offered by the sub-MSO to the professional entity being identical to the services offered by the Master MSO to the sub-MSO. The sub-MSO should provide some unique services to distinguish it from the Master MSO. This could be the number of employees employed by the sub-MSO, or the type of equipment or space subleased by the sub-MSO to the professional entity.

Ancillary to this is the fact that the sub-MSA and main MSA should also be different. This includes how the sub-MSO charges the professional entity being different from how the Master MSO charges the sub-MSO. These are some of the important aspects of fine tuning required for the Master MSO Plan and why it is critical to work with both lawyers and CPAs to distinguish the differences. If there are federal payers involved, re-read Part Three – Regulatory Uses to understand the implications of being subject to the federal laws.

For a more in depth look at the Master MSO Plan in action, consider the following example. A client based in Texas has an MSO formed in Dallas managing a Dallas medical practice and they would like to assist with opening a new medical practice in San Antonio. However, there are certain key investors who will only be affiliated with the San Antonio practice and not the Dallas practice.

In this scenario, the original MSO in Dallas would become the Master MSO and the client would form a sub-MSO in San Antonio where the key investors would invest. This sub-MSO is only managing the San Antonio medical practice. The investors in the Master MSO may own 90% of the sub-MSO with the key investors owning the remaining 10%. Additionally there may be opportunities to offer certain key personnel associated with the San Antonio medical practice ownership which would be in the sub-MSO. The strategy is often called the “golden handcuffs” as it keeps employees engaged at that practice by giving them participation in the profits. If the employee leaves, they lose their ownership. This hopefully incentivizes them to stay.

Contact ByrdAdatto

As this field guide explores the different uses of an MSO, it is powerful to see the creative options that an MSO provides specifically from a business strategy perspective. Selecting the right plan will depend on all of the facts and circumstances and which best allows you to protect the business, create valuable incentives, or accomplish any other desired goals.

In Part Five of this series we will begin discussing the uses for MSOs as part of an exit plan. If you have any questions or would like to learn more about MSOs, email us at info@byrdadatto.com.