There was a time when business owners would have been advised against using an entity taxed as a C-Corporation (“C-Corp”) due to the dreaded “double taxation” effect. However, that advice may not always hold up today, as the evolution of modern business models, especially in health care, private equity, and startups, means that there are situations where using a C-Corp can actually make the most sense.

Entity Types vs. Tax Elections

Before deciding whether a C-Corp is the best fit for your business, it is important to understand the differences between entity types and tax elections. A business’s legal structure determines how a business is organized and governed, while its tax classification dictates how profits are taxed.

When creating an entity, typically, there are two principal filings. The first filing is at the state level, which incorporates the company as a legal entity (i.e., filing as a Limited Liability Company). The second filing (or filings) is with the Internal Revenue Service (“IRS”) to obtain an Employer Identification number. This filing determines how the new entity will be treated from a federal tax perspective.

Together, these factors influence how your business is formed, managed, and taxed, ultimately shaping your financial strategy and long-term goals.

Get more great content with Access+.

What are the Entity Types?

There are a variety of entity types created at the state level, both non-professional and professional. For example, a corporation is a form of entity structure, the ownership of which is represented by shareholders owning the corporation’s shares of capital stock. A limited liability company (“LLC”), on the other hand, is a business structure where the ownership is represented by members owning the LLC’s membership interest. LLCs are the most flexible in how they can be set up and how they may be taxed. Other types of entities include general partnerships, limited partnerships, limited liability partnerships, and non-profit corporations.

In many situations, when licensed professionals seek to offer their services through an entity, they must use a professional entity. These include professional corporations, professional LLCs, professional associations, and service corporations.

What are the Tax Elections?

When it comes time for an entity to make a tax election with the IRS, there are four types that can come into play, depending on the type of entity and the situation.

C-Corp

C-Corp means the legal entity will pay taxes separately from its owners and file its own corporate tax return. With profits that are distributed to shareholders as dividends, those dividends are taxed again at the shareholder level, creating what’s known as “double taxation.” A corporation entity type will default to this tax status. If certain conditions are met, a corporation may elect to be taxed as an S-Corporation (“S-Corp”).

S-Corp

An S-Corp election means that it becomes a pass-through entity for purposes of taxes. The entity itself is not taxed at the entity level, but income, losses, deductions, and credits are passed through and taxed at the owner level based on each owner’s own tax bracket. S-Corps, however, have a number of limitations, which may affect their feasibility when selecting it for a new business.

Partnership Taxation

Like an S-Corp, partnership taxation is on a pass-through basis, meaning the partnership does not pay taxes on its income. Instead, the partners pay tax on their “distributive share” of the partnership’s taxable income, even if no funds are distributed to the partners. The partnership must file an annual information return to report the income, deductions, gains, losses, etc., from its operations, but it does not pay income tax. Each partner includes his or her share of the partnership’s income or loss on his or her tax return. Arguably, partnership tax has the most complicated set of tax laws, rules, and regulations.

Disregarded Entity

Finally, the disregarded entity is a business entity that is ignored (disregarded) for federal income tax purposes, with its profits and losses reported directly on the owner’s personal or parent entity’s tax return.

Why Most Businesses Avoid the C-Corps

Most small businesses operate as pass-through entities because the structure is simpler and avoids double taxation. For business owners who regularly distribute profits or intend to keep their operations small, a C-Corp can often result in a higher overall tax bill.

But the story changes when the company plans to grow, reinvest profits, attract investors, or plan for a sale. In those cases, the C-Corp structure can actually be more tax-efficient and strategically advantageous. With that in mind, let’s explore some of the most common scenarios where having a C-Corp may actually give health care business owners a financial and operational edge.

When a C-Corp Might Be a Better Choice

While no single entity structure fits every situation, there are specific situations where a C-Corp can provide unique advantages over other entity types. These include health care organizations using the management services organization (“MSO”) model, startups planning for a future sale, and businesses seeking outside investment.

Health Care Practices Using an MSO Model

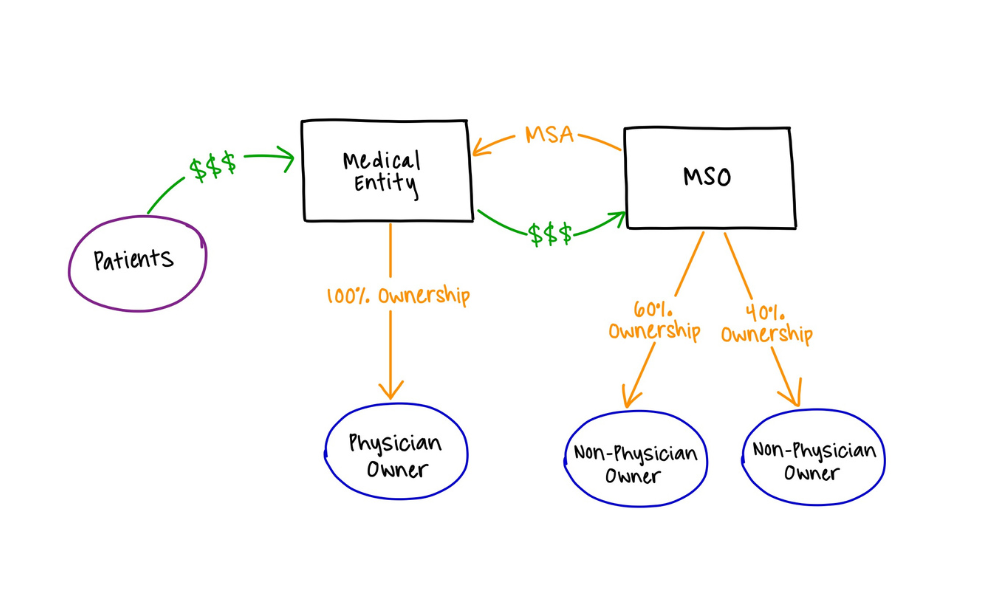

In health care, physicians and non-physician owners often work together through an MSO structure. This model separates the medical entity (which must be physician-owned) from the management entity(which handles business operations such as billing, payroll, and leasing).

Electing C-Corp taxation for the medical entity can help protect physician owners from having revenue and expenses flow through to their personal tax returns, potentially causing unintended tax consequences. Since operational revenue will essentially be washed out by deductible expenses (including the management fee) and the physician owner is typically compensated through 1099 or W2, the intent is that there to be no dividends paid, thus eliminating the double tax issue.

In this setup, the C-Corp serves as a clean tax filter while maintaining compliance with state corporate practice of medicine rules.

Businesses Seeking Venture Capital or Private Equity

If your growth strategy includes outside investors, a C-Corp is often the required structure. Venture capital and private equity funds prefer, or often require, C-Corps for several reasons:

- Many funds cannot legally invest in pass-through entities like S-Corps or partnerships.

- C-Corps can issue multiple classes of stock (common and preferred), which is essential for investor terms.

- C-Corps can offer stock options and incentive plans to attract and retain key employees.

- Corporate stock is easier to sell or transfer in an acquisition or initial public offering (“IPO”).

While a C-Corp offers benefits in specific circumstances, it is not always the best fit.

When a C-Corp May Not Be the Right Fit

Certain scenarios may make other structures more practical or financially responsible. For instance, you may want to consider alternatives if:

- You plan to distribute profits regularly instead of reinvesting them.

- Your business is small or family-owned and unlikely to seek outside investment.

- Your personal income tax rate is lower than the corporate rate.

- You want to avoid potential double taxation on dividends or a future sale of assets.

- Future tax law changes could alter the benefits; corporate and personal rates have fluctuated significantly in the past decade.

Because entity selection affects both your tax obligations and your long-term exit strategy, it’s critical to evaluate your goals before deciding on your structure. Ultimately, understanding where a C-Corp fits within your broader business plan helps you make an informed decision about whether its benefits outweigh its limitations.

What to Keep in Mind When Considering a C-Corp

When thinking about structure, the right choice depends on your growth strategy, tax planning goals, and future exit plans. Here are a few essential points to remember:

- The “double taxation” concern around C-Corps isn’t always a dealbreaker.

- For businesses planning to grow, attract investors, or sell, a C-Corp may offer significant tax and structural advantages.

- For smaller, cash-distribution-focused businesses, an S-Corp or partnership is often still more efficient.

- In health care, combining a C-Corp medical entity with an MSO can provide compliance, operational, and tax benefits.

- Always base your decision on long-term strategy and seek advice from experienced legal and tax professionals.

After weighing your options, it is important to ensure your chosen business structure truly aligns with your long-term objectives.

ByrdAdatto Can Help You Structure Your C-Corp

Choosing the right structure is one of the most important decisions you will make for your practice. Whether you’re launching a health care MSO, expanding your practice, or preparing to sell, understanding the tax and legal implications can save you significant time, money, and risk.

Our legal team works with clients to simplify decision-making and build compliant, strategic structures that allow you to focus on running your business. Contact ByrdAdatto if you are unsure if a C-Corp is the right choice for you.